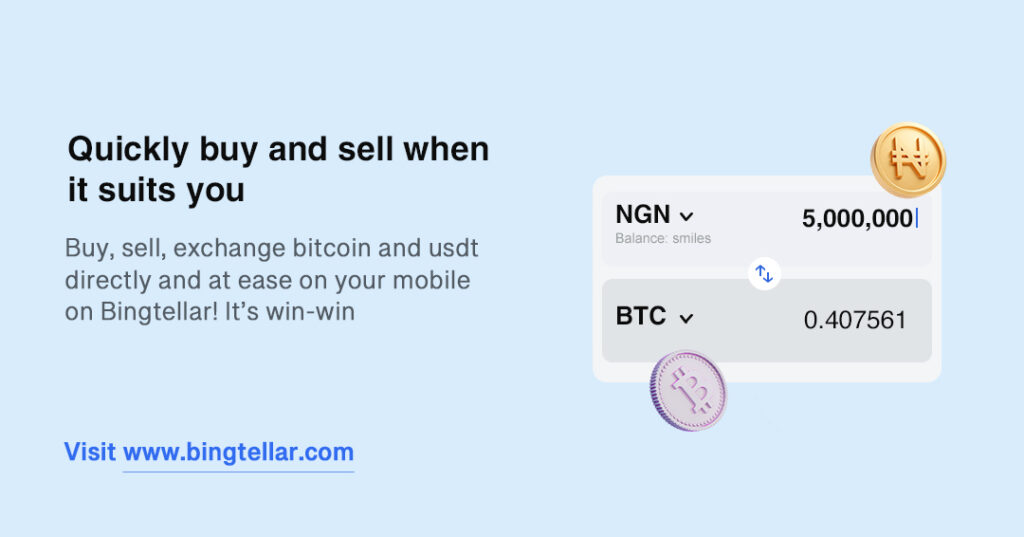

Nigerian blockchain payments startup Bingtellar has announced the launch of its instant crypto-to-fiat conversion service, which enables users and businesses to easily buy and sell cryptocurrencies and get paid in local currencies.

Formed in 2021, Bingtellar allows real-time conversion of crypto to fiat, providing instant liquidity to users in their local currency. Bingtellar has built a payment infrastructure to make the bridge between crypto and fiat as easy as a bank transfer and sending emails, with the process typically taking less than three minutes.

“Paying for goods and services and funding a bank account from a crypto wallet to take care of other bills are a few examples of flexible transactions that are more in demand as crypto gains more prominence,” said Bingtellar founder Joshua Tebepina.

“Speed is a major consideration for these transactions. Payment systems sometimes take about 24-72 hours to remit money from a crypto wallet to a fiat account since major exchanges are built on P2P. The delay makes it a headache when instant transfers are needed.”

The presence of a third-party to facilitate the transfer is part of what makes these transfers slow. Some other sites require a user to convert cryptocurrency to fiat in a naira wallet on the cryptocurrency platform first before transferring to a bank account.

“All of these point to the need for a platform with no third-party restrictions that can facilitate transfers in a very short time. Bingtellar meets the need by carrying out transactions in as little as three minutes and with no third party involved,” said Tebepina.

The self-funded Bingtellar has already processed over US$300,000 in transactions from a few users, and is raising a pre-seed round.

“Growth so far has been great and the feedback has been amazing I must say. I basically started building out Bingtellar as a pet project and a way to help my friends manage the current risk and challenges they experienced with majority of the P2P exchanges, and seeing how far we progressed to where we are at the moment is quite impressive,” Tebepina said.

The service is currently only available in Nigeria, although there are plans to expand into other African countries in the coming months.

“We are currently testing our beta payment payouts in Ghana, Kenya, Uganda and Rwanda. Great uptime, great experience and customer service is something I’m obsessed with, and so we want to be sure we’ve tested things out properly before we open up to more corridors,” said Tebepina.