The LHoFT Foundation has selected 10 African fintech startups to take part in CATAPULT: Inclusion Africa: Special Edition in Dubai, which looks to support companies focused on financial inclusion.

Developed by the LHoFT Foundation, CATAPULT: Inclusion Africa seeks to create real impact in relation to financial inclusion, by providing participant firms with education and insight as well as connectivity, leveraging Luxembourg’s experienced ecosystem of entrepreneurs, finance professionals, and financial inclusion and impact specialists.

This special edition of CATAPULT: Inclusion Africa will be held in Dubai, and is sponsored by the Ministry of Foreign & European Affairs – Directorate for Development and Humanitarian Affairs, with support from the Alliance for Financial Inclusion as well as other key strategic partners such as ADA, AFI, InFine, DIFC FinTech Hive, PwC, Luxembourg Microfinance and Development Fund, Luxembourg For Finance, Dubai UAE Expo 2020 and Compellio.

During the three-day programme, expert speakers and mentors from Luxembourg and UAE will support the selected firms in developing their businesses and achieving their inclusion goals, creating synergies between them, partners, sponsors, investors, microfinance institutions and public financial institutions (PFIs).

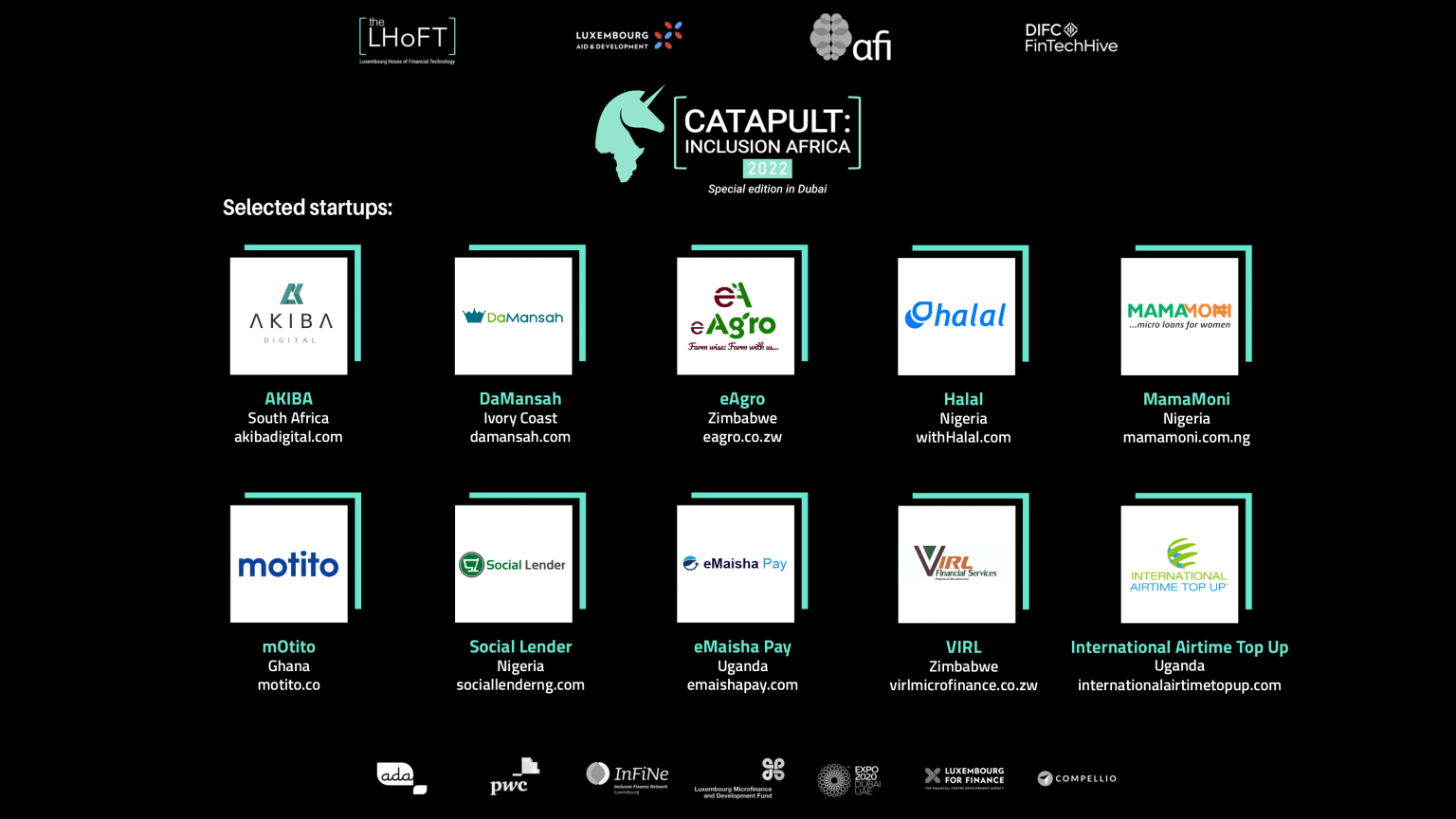

Three of the selected startups are from Nigeria, namely Social Lender, which helps financial institutions to offer financial services based on social reputation to individuals who are underbanked; MamaMoni, which provides micro-loans for low-income female entrepreneurs; and Halal Payment, an all-inclusive digital payments service platform leveraging on Islamic banking system to provide shariah-based financing for SMEs.

Two are from Zimbabwe, in the shape of eAgro, which uses data analytics and machine learning to create low-cost financial credit products tailored to unbanked and underserved farmers’ needs; and VIRL Rural & Social Financial Services, which provides loans to smallholder farmers, micro and small enterprises. Another two are Ugandan, namely eMaisha Pay, a mobile platform that leverages machine learning, alternative data and psychometric parameters to credit score SMEs; and International Airtime Top Up, which offers airtime, money transfers and cash pick-up solutions to and from African corridors.

The cohort is completed by Ghana’s Motito, a “buy now, pay later” platform which provides interest-free credit at point-of-sale; South Africa’s Akiba Digital, an alternative scoring platform that powers credit for small businesses; and Ivory Coast’s Damansah, which is building an alternative credit scoring infrastructure that connects credit providers to small businesses and other thin-filed consumers.

“We are excited to deliver our Catapult programme in Dubai, working with incredible local partners such as the DIFC and Fintech Hive as well as our key Luxembourg sponsor, The Directorate for Development and Humanitarian Aid. We have an incredible lineup of participants picked from over 130 applications, and we look forward to working with them and learning about their businesses. This is a great demonstration of international collaboration between the UAE and Luxembourg, and we believe all mentors and stakeholders involved will benefit from the ecosystems coming together through the Catapult programme,” said Nasir Zubairi, CEO of the LHoFT.